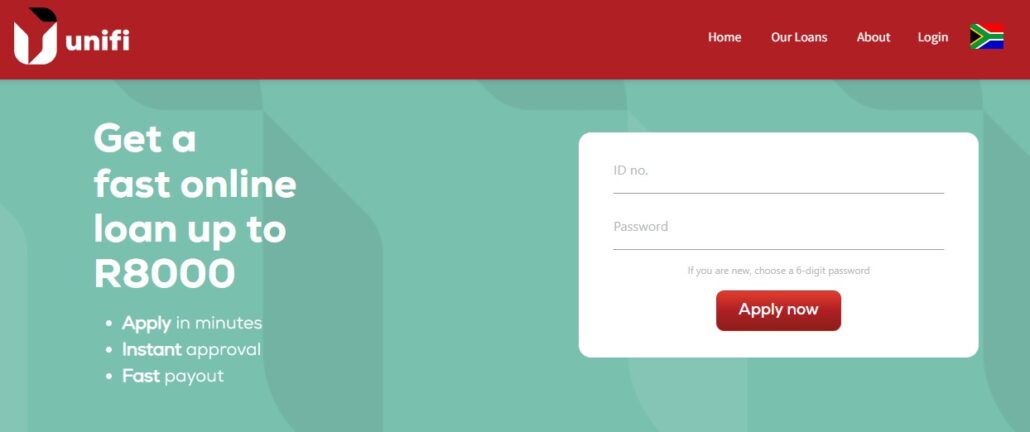

From R1000 to R8000, Unifi Credit offers short-term loans that may be repaid over a period of one to six months. Online loans from reputable lenders like Unifi are quick, easy, and free of hassles like waiting in lines or filling out paperwork. Get up to R8000 now by filling out our fast and easy online application form. Payouts are made within 24 hours. The loan may be repaid within six months. R8000 is the maximum amount that may be borrowed. It’s all done online.

How long does it take for a loan to get approved via Unifi Loans?

Borrowing money from Unifi is quickly approved. Getting a loan approval is as simple as filling out an online application now. In the event of a successful application for a loan, the funds will be sent to your bank account within the next business day. If your credit is solid, the process should proceed more quickly.

You must first meet all of the following requirements in order to be eligible for a loan from Unifi:

- Have a credit score that is above average.

- Meet the minimum age requirement.

- Please provide your most recent bank statements and/or payslips, which cover the past three months.

- Have a South African Identity number that is still active.

- Please provide verification of your address.

If you are able to satisfy these prerequisites, you will need to go on to the further stages of the application procedure. You may submit loan requests on the website by following these steps:

- Sign up for the Unifi loan program by loading the application page into your web browser. You are going to be asked to create a robust password after entering your ID number.

- To apply for a loan from Unifi, complete the online application form.

- Please attach all of the required documentation, including your most recent three bank statements and/or paystubs.

- The decision about your application will be communicated to you as soon as possible.

- After that, you will have to provide your consent to the conditions of the loan agreement, and only after that will the processing of your cash loan get underway.

- If you are approved for the loan, the amount that you requested for will be deposited into the bank account that you have on file on the same day.

A Unifi loan application and approval may be completed in a flash. There is no paperwork, waiting in line, or mandatory meetings required on your part. Instead, you fill out an electronic form, and if you’re regarded a creditworthy debtor, the funds are sent straight to your account. The loan, however, must be paid back within a period of six months.

Everything is done online using Unifi: their online application takes only five minutes to complete, and you’ll be on your way. Your application will be reviewed quickly and if approved, funds will be sent directly to your bank account the same day.

Formal Overview of Unifi Loans

-

Interest Rate:

Annual Percentage Rate (APR): 104% to 212% per annum.

-

Repayment Period:

Flexible repayment options ranging from 1 month to 6 months.

-

Turnaround Time:

Expedited processing with a turnaround time of 24 hours.

-

Monthly Service Fee:

A monthly service fee of R69.

-

Loan Amount:

up to R8,000.

-

Loan Type:

Short-term loans.

Please note that the mentioned details provide a concise summary of the key features associated with Unifi Loans.

Supported Banks by Unifi

- First National Bank (FNB)

- Capitec Bank

- African Bank

- Nedbank

For your convenience, it is important to know that the services offered by Unifi are compatible with the banks stated above, allowing for smooth financial transactions.

You have the option to securely share your proof of income directly with them online through their reputable and secure partner, truID. Their advanced system promptly evaluates your application, providing you with an instant notification regarding the approval status of your personal loan application.